The latest Survey on the trends in projects investment in India, conducted in the first week of January 2023, indicated healthy growth in fresh investment by both the Government and the Private sectors.

Step up in capex intentions by both the Central and State government agencies and a number of high-ticket projects by the Private sector saw the aggregate fresh investment in the first nine months of the current fiscal (i.e. Q1-Q3/FY23) increasing by a healthy 53.18 percent.

In all, 7,555 new projects worth Rs 21,14,773.27 crore were announced in Q1-Q3/FY23 as against 7,978 new projects worth Rs 13,80,540.50 crore announced during the same period a year ago.

Mega Projects

With large-size companies dominating the investment landscape in recent years, the number of mega projects with a cost of Rs 1,000 crore and more has increased. In Q1-Q3/FY23, 280 mega projects were announced. These projects, with an aggregate investment of Rs 14,47,673 crore accounted for around two-thirds of the total fresh investment announced during Q1-Q3/FY23. A year ago, during the same period, 217 mega projects worth Rs 8,31,442.58 crore were announced. The 280 mega projects include 29 super mega projects (cost Rs 10,000 crore or more) consisting of eight Green Hydrogen and Ammonia projects and six Semiconductor and Display Fab projects.

While the increase in the number of mega projects, that too in critical sectors like Green Hydrogen and Semiconductors sectors, shows the confidence of project promoters in India’s growth story, the timely implementation of these projects is critical to realise the goals of Atmanirbhar Bharat.

A Rs 94,500 crore Display Fab project and a Rs 60,000 crore Semiconductors Fab project of the Vedanta group in Gujarat were the top two mega projects announced Q1-Q3/FY23 period. Other mega projects include the Green Hydrogen projects of ACME, ABC, Avaada, JSW, Petronas, Jackson Power, etc.

The Adani group is involved in two super mega projects - a Rs 42,490 crore Dighi Port expansion and a Rs 41,653 crore Alumina Refinery in Odisha.

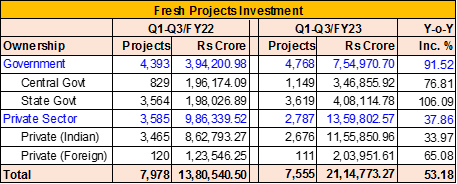

Investment by Ownership

During the first three quarters of FY23, fresh investments in the public sector increased by a whopping 91.52 percent. The central and state-owned agencies both accelerated their capex plans and announced 4,768 new projects with an aggregate investment of Rs 7,54,970.70 crore. A year ago, during the same period, public sector units had announced 4,393 new projects worth Rs 3,94,200.98 crore. As a result, its share in the total fresh investment increased from 28.56 percent in Q1-Q3/FY22 to 35.70 percent in Q1-Q3/FY23.

Total fresh investments in the Private sector increased by 37.86 percent during the first nine months of FY23. Private promoters announced 2,787 new projects worth Rs 13,59,802.57 crore in Q1-Q3/FY23 period. A year ago, during the same period, the sector had announced 3,585 new projects worth Rs 9,86,339.52 crore.

Bulk of the government investment was aimed at building infrastructure, setting up hydel and solar power projects, and smaller size Green Hydrogen projects.

Though, around 40 percent of the fresh private investment was directed towards two critical sectors – Green Hydrogen and Semiconductor Fabs, other sectors like Food Processing, Ethanol, Auto Ancillaries, Hydel Power, Construction and Data Centres too attracted a good amount of investments.

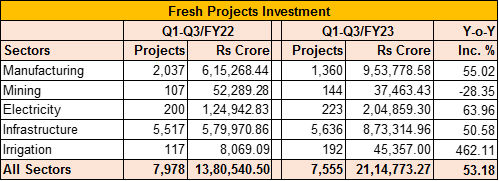

Investment by Sectors

Barring the Mining sector, all other major sectors posted positive growth in terms of fresh investments during the first nine months of FY23.

Manufacturing

In the Manufacturing sector, big-ticket announcements in the Green Hydrogen & Ammonia and Semiconductor and Display Fabs sectors saw the total fresh investment increasing by 55.02 percent on a Y-o-Y basis. Despite a steep fall in the number of new private projects, the sector could post healthy growth in fresh investments because of 20 super mega projects.

As against 2,037 new projects worth Rs 6,15,268.44 crore announced in Q1-Q3/FY22, 1,360 projects worth Rs 9,53,778.58 crore were announced in the first nine months of the current fiscal. Most of the super mega projects were announced in the second quarter of FY23.

Electricity

Revival of interest in setting up large-size Hydro power projects by both private as well as public sector promoters saw the conventional electricity sector attracting 54 new projects with a total capex commitment of Rs 85,266.72 crore during the Survey period. On a Y-o-Y basis, this indicated a rise of 119.74 percent. The 54 projects intend to install fresh generation capacity of 32,382 MW. The Thermal power segment, where the quantum of fresh investments had declined in the last couple of years, saw announcement of 14 new projects with a total generation capacity of 2,510 MW.

The 100-odd solar power projects announced during Q1-Q3/FY23 intend to add new clean generation capacity of 25,913 MW. This also includes a couple of Hybrid (Solar-cum-Wind) power projects. In all, the non-conventional power sector attracted 155 new investment intentions with a total capital outlay of Rs 1,19,592.58 crore, indicating a growth of 40.95 percent on a Y-o-Y basis.

Infrastructure

In the third quarter of FY23, while continuing its investment spree in the roadways sector, the government agencies also invested heavily in sectors like Hydel & Non-Conventional power, Water Supply schemes, and Power Distribution. As a result, fresh investment announcements increased by a healthy 50.58 percent in the Infrastructure sector in Q1-Q3/FY23. During this period, in all 5,636 new infra projects with an aggregate outlay of Rs 8,73,314.96 crore were announced. A year ago, during the same period, the sector saw announcement of 5,517 projects worth Rs 5,79,970.86 crore. Within this sector, Transport infrastructure, Power Distribution and Construction sectors posted healthy growth rates on a Y-o-Y basis.

Roadways: The sector has seen consistent growth in fresh investment in the post COVID-19 period. During the Survey period, fresh investments increased by 69.03 percent. As against 1,216 roadways projects announced in Q1-Q3/FY22, 1,214 new roadways entailing a total investment of Rs 3,07,714.37 crore were announced in Q1-Q3/FY23.

The largest highway project was announced by the Maharashtra State Road Devp. Corpn. MSRDC intends to set up a 179.11 km expressway between Jalna and Nanded at a cost of Rs 22,000 crore. The other two super mega highways projects were announced by the National Highways & Infrastructure Devp. Corpn. (NHIDCL) - Inter-Connectivity Corridor (Upper Siang-West Siang) Project [Package-III] at Rs 15,720 crore and the National Highways Authority of India (NHAI) - Kharagpur-Bardhaman-Morgram Economic Corridor Project at Rs 12,000 crore.

In all, NHAI floated 208 new expressway projects worth Rs 1,67,954.08 crore. Of this, 126 projects will be built in HAM mode. These 208 new highways will create enhanced road connectivity of 8,878 km. NHIDCL on the other hand announced 37 new roadways to be built at a total cost of Rs 28,674 crore.

Railways: As against 35 projects worth Rs 2,974.22 crore announced by the different divisions of Indian Railways in Q1-Q3/FY22, the first three quarters of the current fiscal saw the launching of 190 new railway projects with a total investment intention of Rs 13,189.87 crore. This included around 60 Railway station upgradation projects. The largest railway project launched during the Survey period was Uttar Pradesh Metro Rail Corpn.'s 11.8 km Lucknow Metro Rail Project (Phase-II) to be built at a cost of Rs 5,800 crore.

Ports and Airports: A Rs 42,490 crore Dighi Port expansion by Dighi Port of the Adani group, a Rs 4,118.84 crore Keni port development by Karnataka Maritime Board, a Rs 3,800 crore outer harbour project of Indian Navy and a Rs 1,893 crore Shipbuilding Yard project of Mazagon Dock Shipyard helped the Shipping Infra sector to attract around Rs 54,314.32 crore fresh investment in the form of 36 projects.

Two mega airport projects of Airport Authority of India and a MRO facility at Hyderabad by Safran Aircraft Engines helped the Airport Infra sector to attract fresh investment of Rs 3,826 crore.

Construction Sector: The Construction sector, comprising sub-sectors like Hotels, Hospitals, Community Services, Tourism, Commercials complexes, Real Estate and Industrial Parks recorded a growth of 24 percent during the first nine months of FY23. In all, the Construction sector saw announcement of 2,567 new projects worth Rs 2,92,408 crore against 2,463 projects worth Rs 2,35,830 crore during the first nine months of the preceding fiscal. Real Estate accounted for almost half of the fresh investment announced in the Construction sector. The 1,171 new Real Estate projects entailing a total investment of Rs 1,59,036.64 crore taken up during Q1-Q3/FY23 indicated an increase of 29.73 percent on a Y-o-Y basis. The recent period saw an increase in the number of high-rise buildings and group housing projects in this sector. Hospitals, Other Community services, and Industrial Parks were the other sectors to register positive growth rates in fresh investments.

Irrigation

The state government controlled irrigation sector saw announcement of 192 projects worth Rs 45,357 crore during Q1-Q3/FY23. This included thirteen mega projects worth 28,765 crore. The two notable mega projects were announced by the Water Resources Department, Madhya Pradesh (a Rs 4,806.95 crore Hathpipaliya Micro Lift Irrigation Scheme) and by the Narmada Valley Devp. Authority (a Rs 3,824.40 crore Shakkar Micro Irrigation Scheme).

Investment by States

The year 2022 saw major states re-launching their yearly investment melas to attract private investments. One of the states which benefitted from such summits was the southern state, Karnataka. The “Invest Karnataka 2022 Summit”, held in the first week of November 2022 and the state’s claim of owning around 50,000 acres of land ready for allotment to projects helped the first-ranked Karnataka to attract 699 new projects worth Rs 3,76,885.50 crore in the first nine months of FY23. Nearly 85 percent of the committed investment came in the form of 36 mega projects worth Rs 3,21,056.63 crore. This included Green Hydrogen & Ammonia projects of ACME, ABC Cleantech, Avaada, Petronas, etc. and a super mega Semiconductor fab project of ISMC Analog.

Second ranked Gujarat also benefitted from the presence of 23 mega projects worth Rs 2,46,390.05 crore. During the nine months of FY23, the state attracted 706 projects Rs 2,96,012.13 crore. In September 2022, the state managed to entice the Vedanta group to invest a whopping sum of Rs 1,54,000 crore in twin projects - Semiconductors and Display Fabs.

Third ranked Maharashtra, despite losing a couple of mega projects to other states managed to attract 1,289 new projects worth Rs 2,50,405.77 crore.

The top three states were followed by Odisha (355 new projects worth Rs 1,83,683.98 crore) and Andhra Pradesh (213 new projects worth Rs 1,44,739.26 crore).

The top five states cornered around 59 percent of the total fresh investment announced in Q1-Q3/FY23.

Outlook

The return of the public sector, especially the state government agencies, into the capex arena in the third quarter of FY23 was a welcome development. The total fresh capex commitments of Rs 21.14 lakh crore made during Q1-Q3/FY23 would not only raise the confidence level of foreign investors in India but also would make the mid-size Indian companies, who are not investing heavily currently, line up their investment plans in FY24.

The fall in the number of private projects shows that a number of private companies, despite experiencing high capacity utilization and having enough resources, are adopting a wait-and-watch policy to unravel their capex plans. The rising inputs cost, firming up of interest rates and slow down expected in developed economies are the headwinds making the mid-size Indian companies go slow on their project investment plans.

Given this background, increased investment in infrastructure like Roadways and Multi Modal Logistic Parks, continuation of the PLI scheme and faster grounding of the super mega Green Hydrogen and Semiconductors projects would persuade the private players to expedite their investment plans in FY24.

With the Indian economy expected to grow faster than most of the other economies of the world in FY23 and FY24, Projects Today expects broad-based growth in private investments in FY24.

About Projects Today

Projects Today is India’s largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

Fresh Investment Grew by 9.9% in Q3/FY25... Read more