Union Budget 2023-24 demystifies the emerging pillars for a sustainable growth trajectory. Four pillars viz. Economic Empowerment of Women, PM VIshwakarma Kaushal Samman (PM VIKAS), Tourism and Green growth would ink India’s Amrit Kal for the 100 years of Independence while Saptarishi including Inclusive Development, Reaching the last mile, Youth Power, Financial sector, Green growth, Unleashing the potential, Infrastructure and investment would strengthen the progressive growth trajectory to become a Developed Country by 2047.

The Economic Survey 2022-23 depicted a rosy picture for the economic scenario, going forward. The economy has recovered quickly from pandemic and has achieved the pre- pandemic economic level in 2022-23. The drivers of economic growth such as solid demand, private investments and capital expansion are performing well above the pre-pandemic levels. The CAPEX of Central Government has increased more than 60% in the first eight month of Financial Year 2023. Increase in private capital expenditure has also become visible. The credit growth of the MSME`s is growing at more than 30%. The recovery in employment creation with increasing growth of Government CAPEX and revival of Private CAPEX indicate that economic resilience of the country would be more robust in the coming quarters.

The mitigating strategies of the Government to tackle the impact of Russia-Ukraine conflict are appreciable. Despite the global headwinds economy is able to grow at 7% for the current financial year and projected to grow at 6.5% for the next year 2023-24. Though the economy faced increased interest rates by 450 bps since March 2022 and the inflation trajectory is significantly diminishing, the headline inflation is expected to come sub 5% in FY 2023-24. The rebound in consumption segment and consistent revival of private investments will support the economy to move forward with a strong and sustainable growth momentum. Slowdown in exports will be compensated by sound domestic demand and consistent private investments. In a nutshell, India will remain a bright spot in the global ecosystem for many years and continue to be lucrative for the global investments.

At this backdrop, Smt Nirmala Sitharaman, Honourable Finance Minister, has presented a demand sustaining, investment inducing and growth-oriented union budget 2023-24. The prospects of India’s growth are sound as GDP growth is expected to be 6%-6.8% during 2023- 24 which is highest among the leading economies. Fiscal deficit is estimated to be 5.9% of GDP, thus committing to further bring it down to 4.5% of GDP by 2025-26. India has now become the 5th largest economy of the world. In light of the encouraging growth projections and targeted fiscal deficit in 2023-24 lower than revised estimates of 2022-23, economy is expected to continue in a sustained growth momentum with a controlled inflation trajectory in the year ahead.

There is a significant rise in government capital expenditure by 33% amounting to Rs 10 lakh crore; this will have a multiplier effect on the employment creation, aggregate demand trajectory and private investments. It is inspiring that the budgetary allocation for PLI got a high jump at Rs 8083 crore in 2023-24 for crucial sector of economy i.e. electronics, pharmaceuticals, automobiles and auto components. The Prime Minister Awas Yojana has seen a remarkable 66% increase in its funding, from 47,500 crores in the previous year to 79,000 crores. This is a major highlight of the budget, as it provides much-needed financial assistance to countless low-income households. The generous fund allotment will allow for the improvement of existing resources and provide improved urban housing options to a large portion of the population.

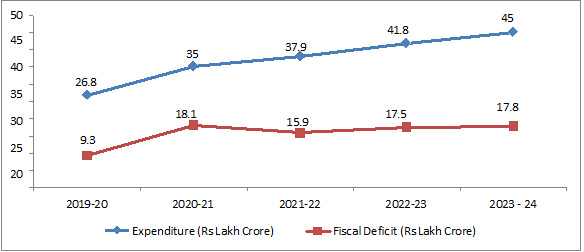

Source: PHD Research Bureau, PHD Chamber of Commerce and Industry

Large number of measures announced to support MSME sector are very timely given the significant role of this sector in country’s GDP and exports. Infusion of Rs 9000 crore for credit guarantee scheme would spur the flow of institutional credit for MSMEs. This would lead to an additional collateral free guaranteed credit of Rs 2 lakh crore and soften the burden of high interest rates for MSMEs. The rise in threshold limit to claim presumptive taxation from Rs 2 crore to Rs 3 crore will benefit small businesses and MSMEs. Vivad se Vishwas scheme has been rolled out which will return 95% of the forfeited amount relating to bid to MSMEs who have failed to execute the contracts during Covid period.

Since India holds the presidency of G-20 and Startup-20 Engagement group, under this endeavour to create conducive global ecosystem for start-ups, tax-friendly announcement for extending the date of incorporation for start-ups to avail income tax benefits to 31st March, 2024 will provide much needed boost to budding entrepreneurs. It also extends the benefits of carry forward of losses on change of shareholding from 7 years to 10 years. The announcement of agriculture accelerator fund will promote agri-startups in rural areas and help farmers to yield more with enhanced productivity vis-à-vis innovative farm techniques. A capital outlay of Rs 2.40 lakh crore for railways, Rs75000 crores for hundred critical transport infrastructure projects and Rs10,000 crores per annum for urban infrastructure development fund (UIDF), 50-years interest-free capex loan worth Rs1.3 trillion will be continued for one more year to aid States to build infrastructure would enhance state of the art infrastructure development in the country.

The recent launch of National Green Hydrogen Mission with an allocation of Rs 19,700 crores to build the ground for building green hydrogen ecosystem would kick-start the green growth participation in India’s GDP trajectory. The Union Budget 2023-24 has given a further push to it by announcing several more measures in this direction. The outlay of Rs 35,000 crores for priority capital investments, viability gap funding for battery energy storage systems would strengthen the green growth initiatives in the country.

It is encouraging that the budget 2023-24 has announced number of provisions for the education sector. National digital library for Children and adolescents will be opened to cover- up the reading loss of children during pandemic times. 30 Skill India Centres will be established to make our youth more competitive and ready for market needs. New courses on medical devices will be launched. 157 New nursing colleges will be opened in India. National Educational policy will focus more on job creation and skilling of the youth through Pradhan Mantri Kaushal Vikas Yojna. This will train them to work in Industry 4.0 via training them in AI, robotics and other new age courses.

| S. No. | Dimension | Description |

| 1 | Size of the Budget | Rs 45 lakh crore |

| 2 | Fiscal Deficit | FY 2023: 6.4% of GDP (RE) FY 2024: 5.9% of GDP (BE) |

| 3 | Vision of Union Budget 2022-23 | India has entered into Amrit Kaal that involves journey to India@100 with a vision which is technology-driven and knowledge-based economy with strong public finances, and a robust financial sector. To service these focus areas in the journey to India@100, the government believes that four opportunities can be transformative during the ‘Amrit Kaal’ — Economic empowerment of women, PM VIshwakarma Kaushal Samman (PM VIKAS), tourism and green growth. |

| 4 | Impact on Economy | The budget estimated the economic growth for current year at 6.5-7% for FY 23 and 6-6.8% for the next FY2023-24. The CAPEX rose to more than 60% for the first eight months. The estimates of nominal GDP growth rate are 10.5% in 2023-24. The estimated fiscal deficit for the year 2023-24 is 5.9%. The target primary deficit for the year 2023-24 is 2.3% of GDP. The path for fiscal consolidation continues to make way for reaching at low fiscal deficit of below 4.5% of GDP by 2025-26.The budget gives provisions for 10 lakh crore which is 3.3% of GDP for capital expenditure. |

| 5 | Agriculture, Allied Activities & Rural Economy | It is proposed to encourage more start-ups to provide farmers technology-based solutions for increasing their crop yields and profitability. An Agricultural Accelerator Fund has been established. This will significantly impact their ability to expand and flourish by addressing issues with finance access and investment. The utilisation of high-frequency data is yet another useful instrument to improve access to high-quality inputs. FM exempted compressed bio-gas (CBG) from excise duty as part of the Rs 10,000 crore GobarDhan programme. |

| 6 | Trade and Industry | The Productivity Linked Incentive earmarked at Rs 8,083 crore out of which Rs 4,645 crore- is for large-scale electronics manufacturing. This will greatly help the manufacturing sector, especially MSMEs, and focus on boosting high employment-generating sectors such as tourism, start-ups, and renewable energy, among others. Enterprises which have failed to execute contracts during the COVID-19 period will be refunded 95 per cent of the amount relating to bid or performance security by the government or government undertakings as part of the ‘Vivad Se Vishwas’ scheme. Many schemes have been given to boost start-ups, textile industry and exporters. |

| 7 | Infrastructure | The capital outlay for infrastructure has been announced to be at INR 10 lakh crore at 3.3% of GDP, apart from making additional expenditure on green transition. The scheme providing 50-year interest free loans to state governments with an outlay of Rs 1.3 lakh crore will be made available in 2023- 24. 100 critical transport infrastructure projects for last and first mile connectivity for various sectors such as ports, coal, and steel will be taken up. This will have an investment of Rs 75,000 crore including Rs 15,000 crore from private sources. |

| 8 | Banking, Finance & Taxation | A resilient economy is built on strong public finances and a robust financial sector. The Union Budget 2023-24 proposes to make innovative use of technology, better and faster service delivery, and easier access to credit and participation in financial markets in order to achieve widespread financial inclusion. The budget has proposed amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act to improve bank governance and enhance investors' protection. Further, SEBI will be empowered to develop, regulate, maintain and enforce norms and standards for education in the National Institute of Securities Markets and to recognize award of degrees, diplomas and certificates. |

It is very inspiring that the custom duty cuts on key components of IT and electronics i.e. camera lens in cellular mobile phones (2.5% to Nil up to 31st March, 2024) and specified parts used in open cell of TV panel (5% to 2.5%) will boost the domestic manufacturing of mobiles and unleash the full potential of domestic TV manufacturing industry. The exemption of custom duty on capital goods for manufacture of lithium-ion cells to be used in electronic vehicles will boost the battery ecosystem and encourage adoption of Electronic vehicles (EVs). Though the strenuous efforts for manufacture of affordable batteries used in mobiles, laptops and EVs are already put in place, the recently announced exemption of custom duties will further provide a big push to the battery ecosystem.

There has been reduction in tax slabs for enhancing consumption expenditure in the economy. It would revive aggregate demand which is crucial to put the Indian economy on higher growth trajectory; raised income tax rebate for salaried class earnings up to Rs 7 lakhs from its previous limit of Rs 5 lakhs will provide substantial relief to millions of individuals and enhance aggregate demand trajectory in the country.

In a nutshell, Budget 2023-24 has been announced at a time when India finds itself in the bright spot as the growth of Indian economy is highest among the leading economies. Going ahead, more and more focus on ease of doing business particularly for the MSMEs, easier compliances for small businesses and exploring the opportunities in the Global Value Chains (GVCs) would go a long way to strengthen India’s growth trajectory and mitigate the impact of global shocks on Indian economy.

(Dr. S.P. Sharma is Chief Economist & Director of Research • PHDCCI (PHD Chamber of Commerce and industry, India)

Disclaimer: The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.

Fresh Investment Grew by 9.9% in Q3/FY25... Read more